Table of Contents

Introduction

In the ever-evolving world of online trading, choosing the right broker is essential for success. FXTM Online Trading Broker stands out as a prominent player, offering a wide range of features and benefits tailored to meet the diverse needs of traders. In this comprehensive guide, we will explore everything you need to know about FXTM, including their account types, trading platforms, fees, commissions, and customer support. Whether you’re a seasoned trader or just starting out, understanding these key aspects will help you make an informed decision and optimize your trading experience.

Account Types and Registration Process

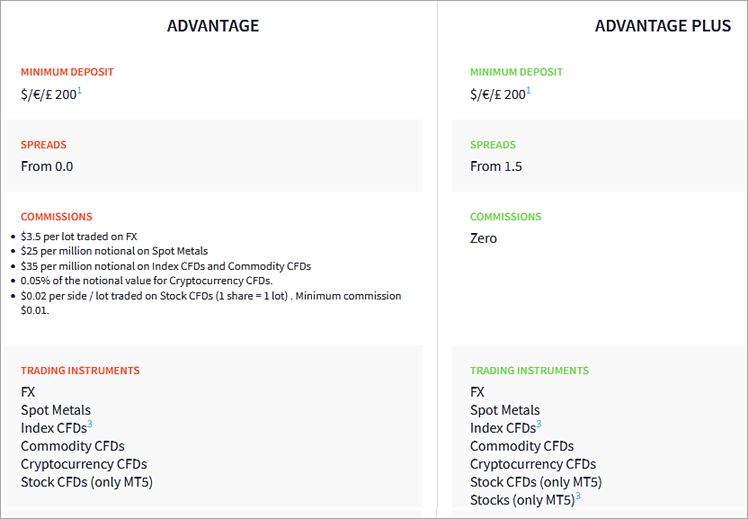

When trading with FXTM Online Trading Broker, choosing the right account type is crucial to match your trading style and goals. FXTM offers two main account types: Advantage and Advantage Plus, each tailored to meet different needs.

Advantage Account: The Advantage account is designed for traders who prioritize low trading costs. It offers some of the tightest spreads in the industry, starting from as low as 0.0 pips, which can significantly enhance your trading profitability. This account type is ideal for those who use strategies that require high precision and minimal slippage, such as scalping and day trading. The Advantage account also features lower commission rates, which further reduces overall trading expenses.

Advantage Plus Account: The Advantage Plus account caters to traders looking for a simplified fee structure with zero commissions on trades. While the spreads are slightly wider compared to the Advantage account, the absence of commission fees makes it a compelling option for those who prefer straightforward cost management. This account type is well-suited for traders who value transparency and ease in their trading experience.

Which Account is Right for You? Choosing between the Advantage and Advantage Plus accounts depends on your trading strategy and cost preferences. If minimizing trading costs and accessing the tightest spreads is your priority, the Advantage account is the better choice. On the other hand, if you prefer not to deal with commission fees and want a more predictable cost structure, the Advantage Plus account may be more suitable.

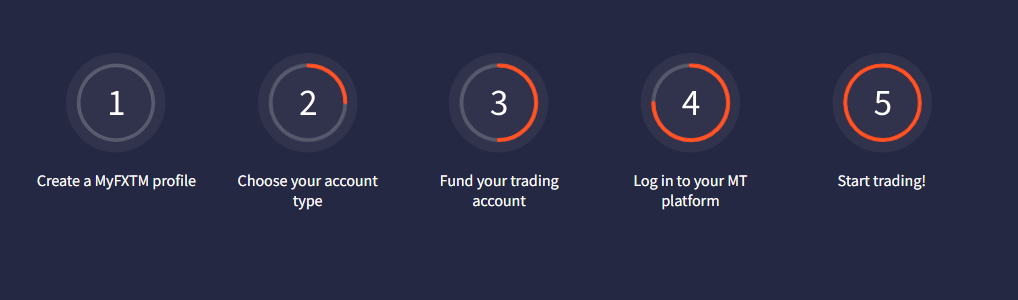

How to open an account

Trading Platforms and Tools

FXTM Online Trading Broker offers a range of advanced trading platforms and tools designed to meet the diverse needs of traders. Whether you’re a beginner or an experienced trader, FXTM provides robust platforms that ensure a seamless trading experience.

MetaTrader 4 (MT4):

MT4 is one of the most popular trading platforms globally, known for its user-friendly interface and powerful features. With FXTM, traders can access a wide range of trading instruments through MT4, including Forex, commodities, and indices. The platform offers advanced charting tools, multiple timeframes, and a variety of order types, making it ideal for technical analysis and automated trading through Expert Advisors (EAs).

MetaTrader 5 (MT5):

MT5 builds on the strengths of MT4, offering additional features and functionalities. It provides more order types, enhanced charting capabilities, and a greater number of indicators. MT5 is suitable for traders who require more sophisticated tools and access to a broader range of financial markets, including stocks and futures. The platform’s multi-asset capabilities make it a versatile choice for those looking to diversify their trading portfolio.

FXTM Trader App:

For traders who prefer to trade on the go, the FXTM Trader app is a powerful mobile trading solution. Available for both Android and iOS devices, the app allows you to manage your trades, monitor market movements, and execute orders from anywhere in the world. The app offers real-time quotes, advanced charting, and push notifications, ensuring you never miss an opportunity.

FXTM Invest:

FXTM Invest is a copy trading program that allows traders to follow and copy the strategies of experienced traders. This tool is particularly beneficial for beginners who want to learn from the best while earning potential profits. With FXTM Invest, you can choose from a wide range of strategy managers, view their performance, and allocate funds to the ones that match your trading goals.

Trading Instruments and Markets

FXTM Online Trading Broker offers a diverse range of trading instruments and access to various financial markets, catering to traders with different preferences and strategies. Whether you are interested in Forex, commodities, indices, or stocks, FXTM provides the tools and opportunities to trade effectively.

Forex Trading: Forex trading is one of the core offerings at FXTM, with over 60 currency pairs available, including major, minor, and exotic pairs. The broker provides competitive spreads, fast execution, and high leverage options, making it an ideal choice for traders who want to capitalize on the dynamic nature of the foreign exchange market. Whether you are a day trader, scalper, or swing trader, FXTM’s Forex trading environment is designed to meet your needs.

Commodities: FXTM also offers trading in various commodities, including precious metals like gold and silver, as well as energy products such as crude oil and natural gas. Commodity trading can be a great way to diversify your portfolio and hedge against inflation. FXTM’s competitive pricing and flexible leverage options make it easier for traders to take positions in these markets.

Indices: For those interested in trading broader market movements, FXTM provides access to a selection of global indices, including the S&P 500, NASDAQ, FTSE 100, and more. Trading indices allows you to speculate on the performance of entire sectors or economies, providing a more diversified approach compared to individual stock trading. With FXTM, you can trade indices with tight spreads and low margin requirements, making it accessible to a wide range of traders.

Stocks: FXTM offers the opportunity to trade shares of some of the world’s leading companies, including tech giants, financial institutions, and more. Stock trading through FXTM allows you to take advantage of market movements in individual companies, with the added benefit of leverage to maximize your trading potential. The broker’s advanced trading platforms provide the necessary tools for detailed analysis and informed decision-making when trading stocks.

Cryptocurrencies: In addition to traditional assets, FXTM provides access to cryptocurrency trading, allowing you to trade popular digital currencies like Bitcoin, Ethereum, and Litecoin. Cryptocurrency trading with FXTM offers high volatility and the potential for significant profits, making it an attractive option for traders looking to explore this rapidly growing market.

Fees, Commissions, and Spreads

Understanding the cost structure is crucial when choosing a trading broker. FXTM Online Trading Broker is transparent about its fees, commissions, and spreads, ensuring traders have a clear understanding of what they will be paying. This transparency allows you to better plan your trading strategies and manage your costs effectively.

Spreads: Spreads are a key component of trading costs, representing the difference between the bid and ask prices of an asset. FXTM offers competitive spreads across all account types, ensuring that traders get the best possible prices. The Advantage Account provides some of the tightest spreads in the industry, starting from as low as 0.0 pips on major currency pairs. For traders using the Advantage Plus Account, spreads start from 1.5 pips, with no commission fees, making it a great option for those who prefer a straightforward cost structure.

Commissions: While the Advantage Plus Account has no commission fees, the Advantage Account charges a small commission per trade. This commission varies depending on the trading instrument and account type but is generally low, ranging from $0.40 to $2 per lot. The low commissions combined with tight spreads make the Advantage Account a cost-effective option for traders who prioritize minimal trading costs.

Swap Fees: Swap fees, also known as overnight or rollover fees, are charged when a position is held open overnight. FXTM applies these fees based on the interest rate differential between the two currencies in a pair. However, FXTM offers swap-free accounts for traders who do not wish to pay or receive interest due to religious beliefs, ensuring that everyone has access to fair trading conditions.

Deposit and Withdrawal Fees: FXTM is committed to providing cost-effective trading, and this extends to deposit and withdrawal fees. Most deposit methods are free of charge, while withdrawal fees are kept to a minimum, depending on the method chosen. FXTM also offers fast processing times, ensuring that your funds are available when you need them.

ForexTime Deposits & Withdrawals

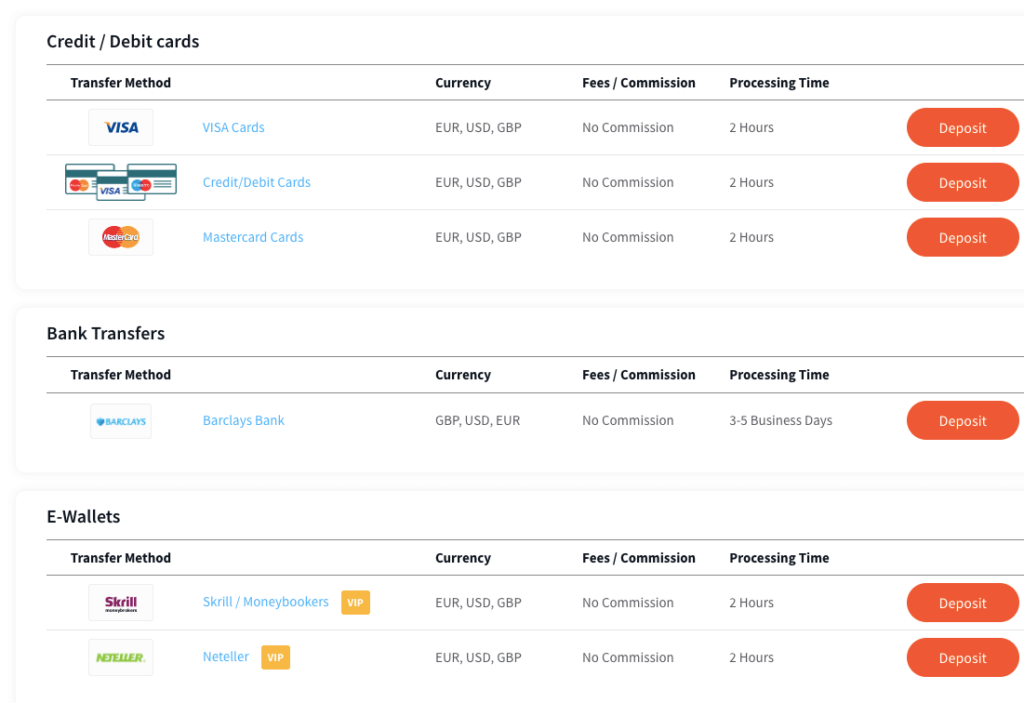

Managing your funds efficiently is crucial for a seamless trading experience, and FXTM Online Trading Broker 2024 ensures that deposits and withdrawals are straightforward and secure. With a variety of payment methods and quick processing times, FXTM makes it easy for traders to access their funds whenever needed.

Deposit Methods: FXTM offers a wide range of deposit methods to cater to traders from different regions. You can fund your account using traditional methods like bank transfers and credit/debit cards (Visa, MasterCard), as well as modern options such as e-wallets (Skrill, Neteller) and local payment solutions. Most deposit methods are processed instantly or within a few hours, allowing you to start trading without delay. Additionally, FXTM does not charge any fees for deposits, ensuring that the full amount you transfer is credited to your trading account.

Withdrawal Options: Withdrawing funds from your FXTM account is just as easy as making a deposit. FXTM supports various withdrawal methods, including bank transfers, credit/debit cards, and e-wallets. Withdrawal requests are typically processed within 24 hours, though the time it takes for funds to reach your account may vary depending on the method used. While FXTM strives to keep withdrawal fees low, some methods may incur a small charge, which is clearly outlined during the withdrawal process.

Processing Times and Fees: FXTM is known for its fast processing times for both deposits and withdrawals. E-wallet withdrawals are usually the quickest, often completed within minutes, while bank transfers may take a few business days. It’s important to note that while FXTM does not charge fees for deposits, withdrawal fees may apply depending on the method chosen. These fees are minimal and are designed to cover the costs associated with the transaction process.

Security and Transparency: Security is a top priority at FXTM, and this extends to their deposit and withdrawal processes. All transactions are encrypted using advanced SSL technology, ensuring that your financial information remains secure. FXTM is also fully transparent about any potential fees and processing times, so you can plan your transactions accordingly without any surprises.

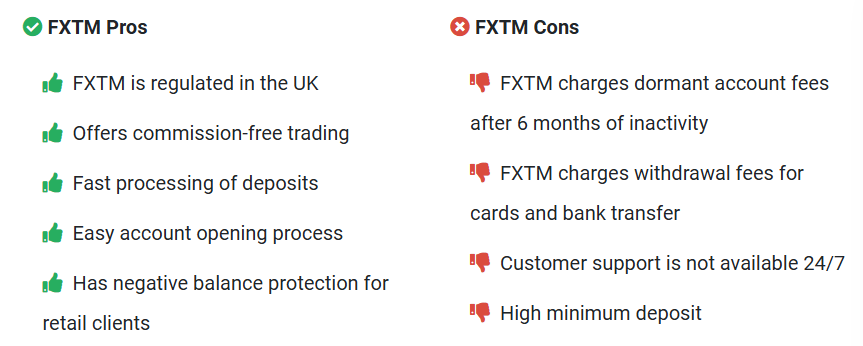

FXTM Pros & Cons

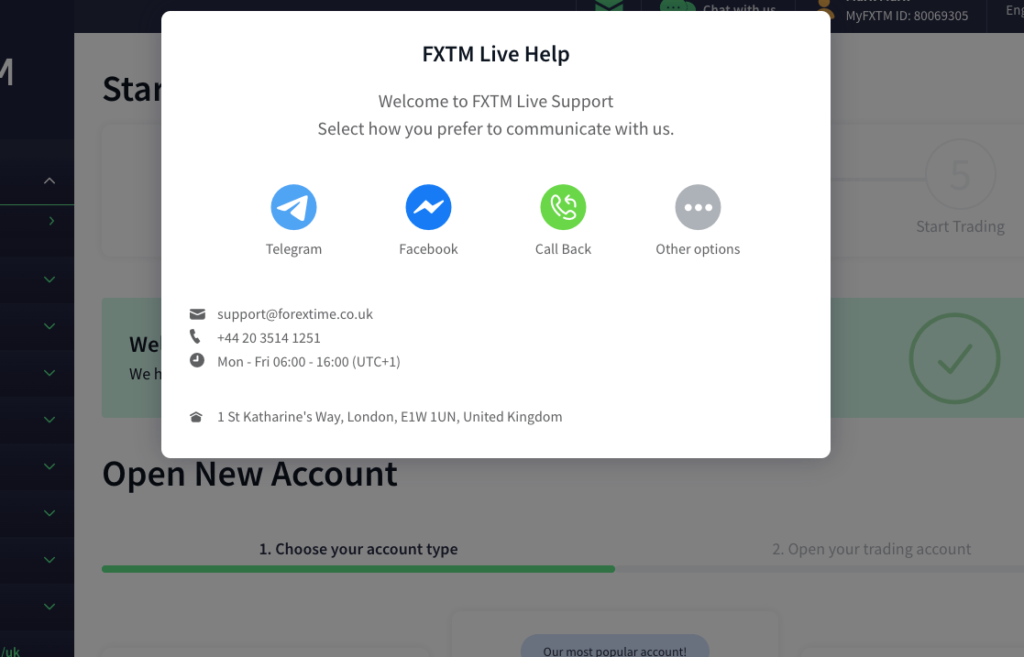

Customer Support

One of the key factors that sets FXTM Online Trading Broker apart is its commitment to providing exceptional customer support. Whether you are a seasoned trader or just starting, having reliable and accessible support is crucial for a seamless trading experience.

24/5 Availability: FXTM offers customer support 24 hours a day, five days a week, ensuring that you can get assistance whenever the markets are open. This around-the-clock availability is particularly beneficial for traders operating in different time zones or those who trade during off-peak hours. You can reach out to FXTM’s support team at any time during the trading week, knowing that help is just a call or click away.

Multilingual Support: Understanding that FXTM serves a global clientele, the broker provides multilingual support to cater to traders from various regions. FXTM’s customer service team is proficient in several languages, including English, Arabic, Chinese, Russian, Spanish, and more. This ensures that you can communicate effectively and get the help you need in your preferred language.

Multiple Contact Channels: FXTM offers a variety of contact options to suit your preferences. You can reach their customer support team via live chat, email, phone, or even social media platforms. The live chat feature is particularly popular for its quick response times, allowing you to resolve issues or get answers to your questions in real time. Additionally, the broker provides a detailed FAQ section on their website, where you can find answers to common questions without needing to contact support.

Personal Account Managers: For traders who require more personalized assistance, FXTM offers the option of having a dedicated account manager. Personal account managers provide tailored support and guidance, helping you navigate the platform, understand market trends, and make informed trading decisions. This level of service is especially valuable for new traders or those looking to develop more advanced trading strategies.

Educational Resources and Webinars: In addition to direct customer support, FXTM also offers a wealth of educational resources, including webinars, tutorials, and market analysis. These resources are designed to help traders of all levels improve their skills and stay informed about market developments. The educational materials are easily accessible on FXTM’s website, providing added value to your trading experience.

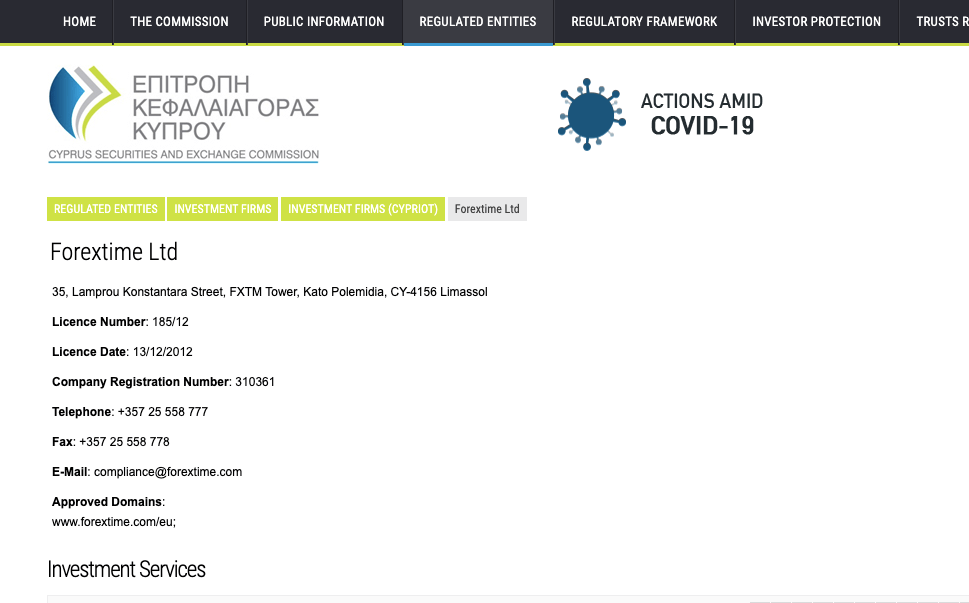

Regulation and Security

When choosing a broker, regulation and security are paramount considerations. FXTM Online Trading Broker is committed to maintaining the highest standards of safety and compliance, ensuring that your funds and personal information are well-protected.

Regulatory Oversight: FXTM is regulated by several reputable financial authorities, which underscores its credibility and commitment to transparency. The broker is licensed by top-tier regulatory bodies, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa. These licenses require FXTM to adhere to strict guidelines on operational practices, client fund protection, and financial reporting, giving traders peace of mind that they are dealing with a legitimate and trustworthy broker.

Client Fund Protection: To enhance security, FXTM follows stringent client fund protection measures. All client funds are kept in segregated accounts, separate from the company’s operating funds. This segregation ensures that your money is only used for trading purposes and is protected in the unlikely event of company insolvency. Additionally, FXTM participates in compensation schemes that provide further protection to clients in case of unforeseen circumstances.

Data Security: FXTM employs advanced encryption technology to safeguard your personal and financial information. The broker uses Secure Socket Layer (SSL) technology to encrypt data transmissions, ensuring that all communications between the client and the broker’s servers are secure. This commitment to data protection ensures that your sensitive information remains confidential and protected from cyber threats.

Compliance with International Standards: FXTM complies with the Anti-Money Laundering (AML) and Know Your Customer (KYC) policies, which are critical in preventing financial crimes and ensuring the safety of the trading environment. These compliance measures require clients to verify their identity and source of funds, which helps prevent fraudulent activities and ensures a secure trading experience.

Conclusion

In 2024, FXTM Online Trading Broker continues to stand out as a reliable and versatile option for traders of all levels. With a variety of account types, competitive fees, advanced trading platforms, and strong regulatory oversight, FXTM offers a robust trading experience. While there are some considerations, such as withdrawal fees and a limited range of cryptocurrencies, the overall benefits make FXTM a strong contender in the online trading space. Whether you’re a beginner or an experienced trader, FXTM provides the tools and support you need to succeed in the financial markets.